Free Payroll Course

This page contains our free online payroll course. It will teach you the basics of payroll and give you the training you need to start running payroll.

The Course Covers:

The basics of payroll

How to do payroll journals

The fundamentals of payroll accounting

Course Modules:

Lesson 1: The Complete Payroll Process

Lesson 2: Wages Journals

*Bonus Lesson* Top 5 Payroll Tips

To start the online course, scroll down

This course is FREE, and no registration is required.

It is perfect for beginners!

Jump to:

Online Payroll Training Course

Part 1: The Payroll Process

Module overview:

-

Payslip Explanation

-

Gross and Net Wages

-

Payroll Software

-

The Payroll Process

1.1 What is payroll?

Definition: Payroll is the accounting of employees' wages and salaries.

It includes accounting for gross wages, net wages, bonuses, commissions, tax deductions, student loan deductions, national insurance payments (social security), benefits-in-kind and other important information.

Payroll accounting also includes reporting to governmental bodies, such as HMRC.

Payroll is done using payroll software. Typically, the software performs all the tax calculations and generates reports for you. However, the amount each employee has earned, as well as other employee details, is usually entered manually.

1.2 Key Payroll Terms Explained

Here are key terms used in payroll:

Gross wages - the amount paid to an employee before tax and other deductions

Net wages - the amount paid to an employee after tax and other deductions

Student loan deductions - the amount deducted from an employee's gross salary to repay the employee's student loan

National insurance (social security) - the amount deducted from an employee's gross salary to cover state pension, job seekers allowance, employment support, and other welfare support.

Other deductions - pension contributions, salary sacrifice, etc.

Employers' NIC (or tax) - tax paid by the employer, usually based on how much an employee is paid.

Employers' pension contributions - the contributions toward an employee's pension.

1.3. Why does payroll need to be done?

Employees need to be paid. Accurate payroll accounting ensures that these payments are correct and that all necessary deductions and tax payments are made and reported accurately.

The payments to employees, the costs incurred, and the amounts owed must be accounted for in the financial accounts. This is usually done using wages journals.

1.4 Wage slip, payslip example

1.5 Wage slips and pay slips explained

A wage or pay slip shows an employee's pay and deductions for a specified period. The crucial takeaway points are:

-

The slip displays the details of both the employer and the employee, including their names.

-

The period the pay is for. This is generally a month, but can be a fortnight or other period

-

The gross pay for the period. Gross income refers to the total amount of pay before tax and other deductions.

-

The deductions for the period. This can include tax, national insurance (social security), pension contributions, student loan deductions, and other deductions.

-

The net pay for the period. This is the pay after all deductions (gross pay minus deductions equals net income).

-

The gross pay, deductions, and net pay from the start of the tax year to date.

A wage or pay slip must be provided by law. In the UK, the wage or pay slip must be provided on or before the employee's payment date.

1.6 What's involved in payroll accounting?

The payroll process can be broken into five main steps:

1. Collection of data. This includes collecting data on employees, such as their names, addresses, identification numbers, etc. This also includes collecting data on how much employees have earned, such as a fixed salary, hours worked, and commissions earned.

2. Processing payroll. This is completed using payroll software. A significant part of this step involves entering wage data into the software, which will then generate payslips for each employee. This step can also include creating year-end reports for employees, such as P60's.

3. Submission of data. Once all data has been entered into payroll software, the information must be submitted to the appropriate governmental bodies. There are usually submission deadlines, so ensure everything is submitted on time!

4. Wages journals. All wages, salaries, deductions, and payments must be accounted for in the financial accounts. This is typically accomplished through a series of journals that track the expenses and liabilities incurred during the payroll process. Wages journals will be covered in the next section of this course.

5. Make payment. Any monies owed to employees and governmental bodies are paid.

FREE trial on Payroll Software?

Part 2: Wages Journals Explained

Module overview:

-

Payroll Journals

-

Accounting for Deductions

-

And more

2.1 Wages journals explained

Wage journals are used to account for the expenses incurred and amounts owed after the payroll cycle. They are posted as often as the payroll is run.

They consist of:

-

Gross wage (expense to the company)

-

Net pay (liability owed to employee)

-

Deductions (liabilities owed to governmental and other bodies)

-

Other expenses incurred by the company, such as employer NI and employer pension contributions

Without a wages journal, the expenses and liabilities would not be accounted for correctly.

Wages journals use the following nominal accounts:

-

Gross wages expense

-

Net wages control liability

-

PAYE liability (or income tax liability)

-

NI liability (or social security liability)

-

Student loan liability

-

Employer pension contributions expense

-

Employer NI contributions expense

Pitstop Practice!

Explain:

What is payroll?

What are payroll journals?

How is payroll done?

Okay? Continue!

If not, consider my Accounting Mentor Program

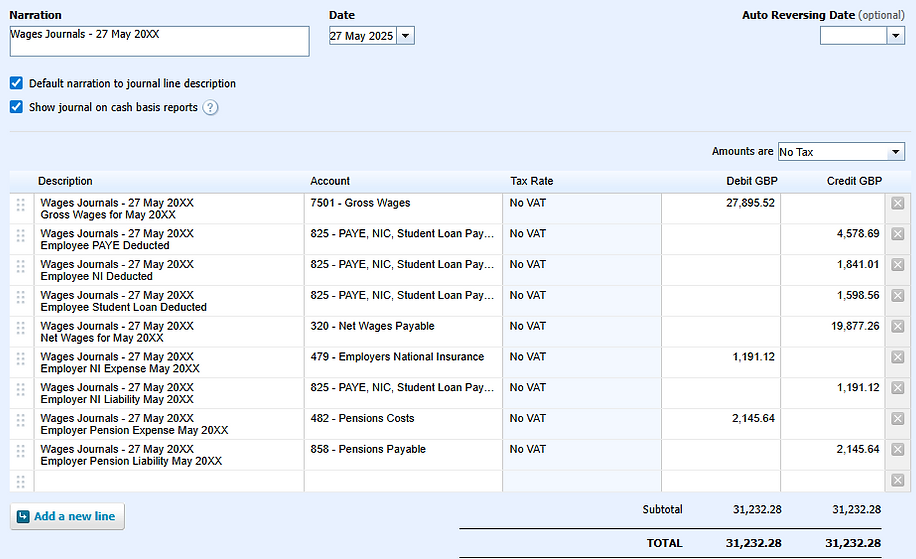

2.2 Wages journal examples

Here is an example of wages journals. I've split the wages journals into three segments for ease of understanding.

Employees Wages

Debit - Gross Wages (expense). This is the expense incurred by the employer.

Credit - Net Wages Payable / Control Account (liability). This is the net wage owed to employees.

Credit - PAYE Liability. This is the income tax deducted from the employee's wages and owed to HMRC.

Credit - NI Liability. This is the national insurance deducted from the employee's wages and owed to HMRC.

Credit - Student Loan Liability. This is the student loan deducted from the employee's wages and owed to HMRC.

Credit - Pension Liability. These are the pension contributions made by the employee's and owed to the pension provider.

Employer NI Contributions

Debit - Employer NI Contributions (expense). The NI expense incurred by the employer.

Credit - NI Liability. The employer's NI contributions owed to HMRC.

Employer Pension Contributions

Debit - Employer Pension Contributions (expense). The pension expense incurred by the employer.

Credit - Pension Liability. The employer's pension contributions owed to HMRC.

Journal Example

2.3 Next

When the wages are paid to the employees, the payment mustn't be allocated as an expense, as the wages expense has already been accounted for in the wages journal. Instead, employee payments are posted to the net wages control account, clearing the liability owed to employees.

This applies to income tax (PAYE), national insurance (social security), pension, and student loan payments.